By way of Bill factoring, a business can use its invoices to borrow the quantity its consumers can pay Down the road: The lender gets the Bill and its potential payment, though the business will get shorter-term funding.

This page is usually a totally free on line source that strives to supply handy content and comparison functions to our site visitors. We take advertising and marketing payment from businesses that seem on the location, which may impact The placement and order in which models (and/or their merchandise) are introduced, and will also impression the rating which is assigned to it.

We feel everyone need to be capable of make fiscal selections with self-confidence. And though our website doesn’t element just about every business or money products offered on the market, we’re proud which the steerage we provide, the knowledge we provide plus the applications we produce are objective, independent, easy — and no cost.

In many situations, the tools acts as collateral with the loan. Even so, some lenders could involve businesses to Individually assurance payment, Placing them selves and their other belongings in danger whenever they are unsuccessful to repay.

Max curiosity charges are pegged to some base charge, utilizing the key fee, LIBOR price, or an optional peg fee—but typically the prime level revealed with the Wall Street Journal. In general, the primary price is 300 factors earlier mentioned the federal resources price.

Comparing your choices is The ultimate way to ensure you’re receiving the fantastic small business loan in your business. Consider the next components when deciding which loan 504 SBA loan Reno is good for you:

A business owner can submit an application for a business loan to cover significant or extensive-expression costs, including equipment or property purchases.

Study the basics of what a line of credit rating is And exactly how it can be used to offer supplemental funding for the business.

We predict your business is way too significant for your a single-dimensions-fits-all approach to business banking. Take a look at our choices and decide the one which’s ideal for you.

Assess lenders. Take into consideration factors like how rapidly they disburse cash, the lender’s name, and whether you favor to apply in man or woman or on the web.

With decreased rates, it is possible to Increase your business when preserving 1000's on payments. Look at leading lenders and lock with your rate right now.

This page is usually a totally free on the web useful resource that strives to offer beneficial information and comparison features to our site visitors. We accept marketing compensation from organizations that show up on the location, which can impression The situation and buy through which makes (and/or their products and solutions) are introduced, and should also impression the rating that's assigned to it.

Try to remember, a loan is a binding settlement for the provided time period, and when you indicator the documentation, you’re dedicated to paying out the a refund in accordance with the agreed-upon terms. Be sure to know exactly what you’re getting into before the loan is finalized.

Owning federal government backing enables lenders to take on extra hazards when it comes to giving loans to small businesses. While in the 2020 fiscal year, lenders issued a blended $28 billion in SBA loans.

Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Michelle Pfeiffer Then & Now!

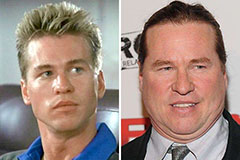

Michelle Pfeiffer Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Mike Vitar Then & Now!

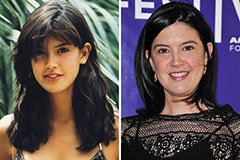

Mike Vitar Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!